Blog

Encouraging Multiple Offers

Post Date: 10-06-2021

Based on the current competition due to lower than normal inventories, it is possible for a seller to find themselves on the beneficiary side of a multiple offers. Two or more parties may be trying to buy your home at the same time and because of the competition, they increase the purchase price, possibly, remove unnecessary contingencies and try to make their offer as attractive as possible. ...CONTINUE READING

No Need to Make Common Mistakes

Post Date: 09-22-2021

A successful home sale, considered by many owners, is to maximize their proceeds in the shortest time with the least inconveniences. Just because it is a seller's market doesn't mean that homeowners can shortcut some of the steps that make it happen and they certainly need to avoid commonly made mistakes. ...CONTINUE READING

A Lesson from a Pro

Post Date: 09-15-2021

A well-known professional home stager, recently, decided to sell the 4,000+ square foot home which she lived in with her husband. It was certainly well maintained and by most standards, could have gone on the market immediately. However, she still went through a full staging effort before she listed the home.

...CONTINUE READING

Equity, Price and the Agent You Select

Post Date: 09-08-2021

A Seller's equity in their home is the difference between what the home is worth and what they owe. At any point in time, it is an estimation because value is a very subjective term. If the seller thinks the home is worth more than an actual buyer will pay for it, the estimated equity is too high. If a buyer is willing to pay more than the seller believes the home is worth, the estimated equity is too low. ...CONTINUE READING

Rising Rents - Music to Your Ears?

Post Date: 09-01-2021

Rents going up may not be pleasant to hear for tenants, but it could be music to your ears if you are an investor. ...CONTINUE READING

Homeownership Cycle and Inventory

Post Date: 08-25-2021

An interesting homeownership cycle begins with a starter home and progresses to larger and smaller homes throughout a person's lifetime. Within a few years after purchasing their initial home, they might move up to a little larger house. The reasons could be that they simply want a larger home and can afford it, or their increased family size may be motivating the move. ...CONTINUE READING

Mortgage Forbearance

Post Date: 08-18-2021

Some homeowners who could not afford to make their mortgage payments this past year have been relieved to find out that their mortgage servicer or lender allowed them to pause or possibly, reduce their payments for a limited period. While it does relieve the financial pressure, it is a temporary remedy. ...CONTINUE READING

Selecting the Right Agent in a Seller's Market

Post Date: 08-12-2021

Even in the current, low inventory housing market, sellers are resisting the urge to sell it themselves and still seeking the help of a real estate professional. It may be more important than ever and there is too much at stake to risk going it alone. ...CONTINUE READING

A Sad Story Relived Over and Over

Post Date: 08-04-2021

Ask any real estate agent and they will tell you a similar sad story. The seller, whose home just hit the market, received an offer which was less than the list price, but felt secure their home would sell quickly and countered for more. For whatever reason, the buyer did not continue to negotiate and moved on. ...CONTINUE READING

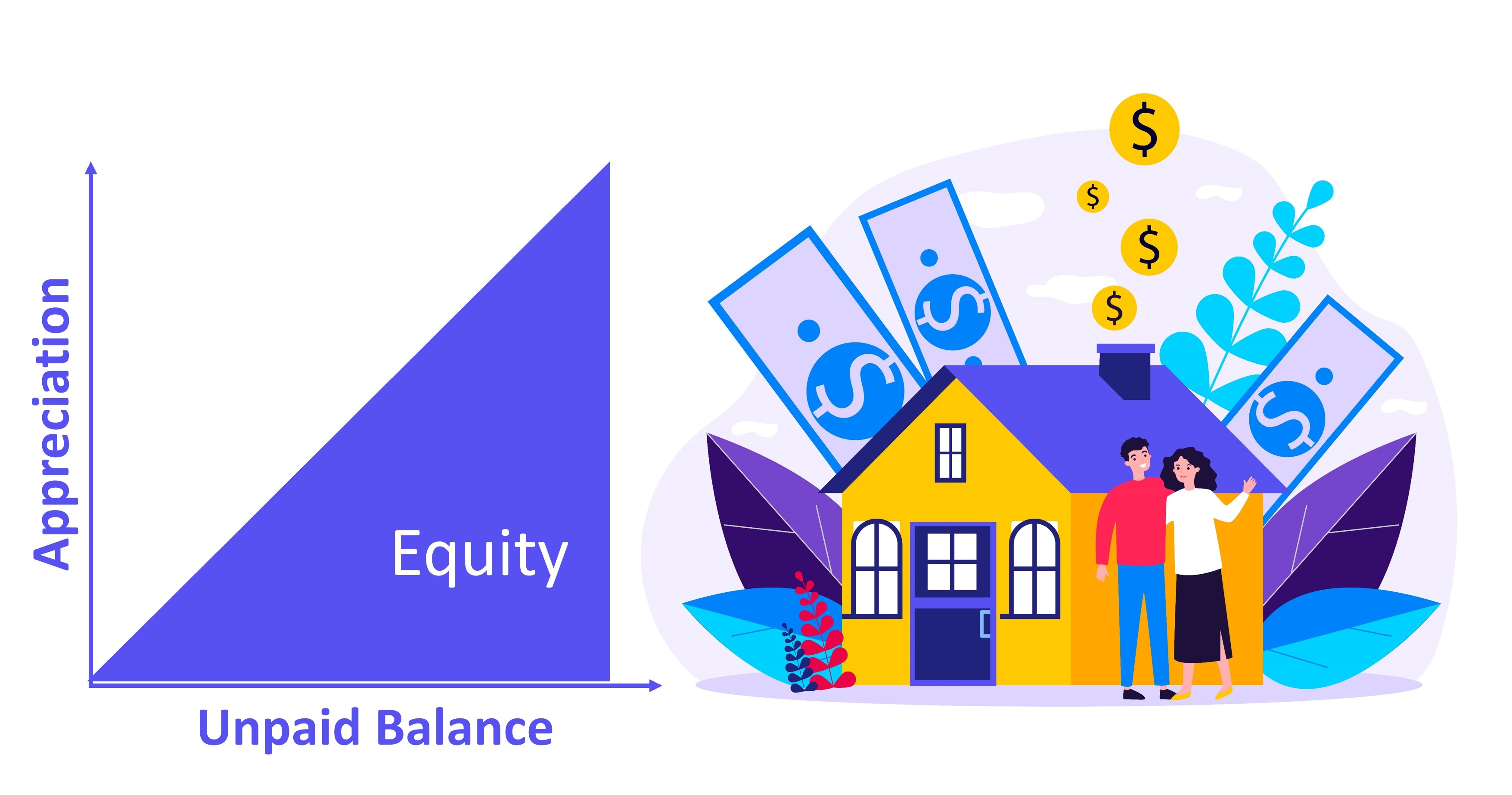

The Dynamics of Home Equity

Post Date: 07-28-2021

For many people, their home is their largest asset and their best performing investment. The equity in a home is the difference in what it is worth and what is owed. Two dynamics, appreciation and unpaid balance, work in concert to make homeowner's equity grow. ...CONTINUE READING