Blog

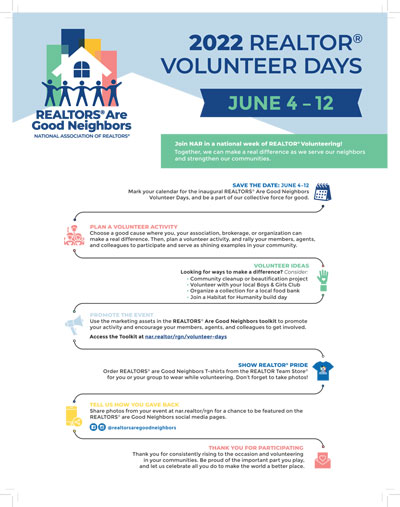

2022 REALTOR® Volunteer Days

Post Date: 05-24-2022

Join NAR in a national week of REALTOR® Volunteering! Together, we can make a real difference as we serve our neighbors and strengthen our communities. ...CONTINUE READING

Existing Homeowners May be Facing Higher Payments

Post Date: 05-18-2022

As a current homeowner, you may be basking in the consolation that you bought before the market got crazy with higher prices and interest rates. However, it doesn't mean that you may not be facing higher mortgage payments for next year. ...CONTINUE READING

Homeownership and the Three M's

Post Date: 05-11-2022

Homes are valuable assets and must be maintained so they function properly, are safe, enjoyable and hold their value. Attention to maintenance, minimizing expenses and managing debt & risk will protect your investment. ...CONTINUE READING

Will Selling Your Home Increase Your Tax Bill?

Post Date: 05-04-2022

With home prices rising 20% nationwide in the past year and in some markets, even dramatically more, many homeowners are excited about the equity in their homes. In the past, most homeowners were not concerned about profit from the sale being taxed but some may be surprised. ...CONTINUE READING

Buying a Home...Ask for a CLUE Report

Post Date: 04-27-2022

People purchasing a used car have most likely heard of CARFAX vehicle history reports to help them avoid buying a car with costly hidden problems. Less likely are buyers to know that there is a way to discover some of the repair history of homes they are interested in. ...CONTINUE READING

Coordinating the Sale and Purchase of Your Home

Post Date: 04-20-2022

Usually, it is easier to buy a home than to sell a home but that isn't necessarily the case currently. In today's market, it can be scary to sell your home before buying another because you could find yourself without a home. ...CONTINUE READING

A New Opportunity for Homebuyers

Post Date: 04-13-2022

You may not have heard of anyone assuming an existing mortgage for over thirty years and didn't know they were even possible any longer. The reason is simple, it didn't make financial sense but now that interest rates are increasing, it may be an opportunity for some homebuyers. ...CONTINUE READING

Cost of Waiting to Buy in Both Price and Interest Rates

Post Date: 04-06-2022

Have you ever been shopping on a website where you were looking at something that was on sale? You were interested in it but there wasn't a sense of urgency and maybe, you had a lot going on and didn't get back to it for a few days. When you did go back to the website, the price on the item had returned to its regular price. ...CONTINUE READING

Instead of a vision, show them the house

Post Date: 03-30-2022

Sellers try to rationalize not making needed updating and repairs to their homes before marketing them by saying they are going to let the buyers make their own personal choices. It is a convenient story to justify not going to the effort for the necessary market preparation to justify achieving the highest possible sales price. ...CONTINUE READING

Equity Give Homeowners Options

Post Date: 03-23-2022

Americans have seen the equity in their homes increase by 29.3% year over year in the fourth quarter of 2021 according to the CoreLogic Homeowner Equity Insights. The average home equity gained $55,000 during the same period. ...CONTINUE READING